Wellness Plan Compliance

Wellness programs are very popular with employers who are looking for ways to reduce health care costs. These programs run the gamut from simple health fairs to comprehensive health screenings with medical tests. How a wellness program is structured and what services it provides will determine what laws regulate it.

Be forewarned that for such a seemingly simple program, the laws can get very complicated, very quickly and are still evolving. Therefore, when designing a wellness program, employers should take the time to understand its objectives in relation to the associated legal governance.

Wellness Plans as Group Health Plans (GHPs)

When is a wellness program a group health plan (GHP)?

Being a GHP is a significant distinction for purposes of compliance. Consider all the laws that govern your medical plan – most of those laws apply because the medical plan is a GHP.

A wellness program may be considered a group health plan if it provides medical care. Although the definition of medical care differs somewhat among the various regulations, from a wellness perspective, medical care generally includes biometric tests for blood pressure, cholesterol, and blood sugar, as well as immunizations and disease management programs.

When is a wellness program NOT a GHP?

If a wellness program does not meet the criteria mentioned in the previous section, it is generally not considered a GHP. This is easiest to illustrate with examples. The following programs are not GHPs:

- Programs that pay for health or weight-loss club dues;

- Programs that award T-shirts to persons who walk a certain number of miles;

- Programs that provide health information only;

- Programs that do not provide or pay for medical or health benefits and offer an incentive that is completely unconnected to a group health plan (for example, a program awarding bonuses, higher pay, or additional vacation days to employees who do not smoke); or

- A stand-alone health-risk questionnaire program that does not provide or pay for health benefits.

This doesn’t mean the that these programs are entirely unregulated, it’s just that the compliance burden is significantly less. Even non-GHPs must ensure that their wellness programs in no way discriminate against individuals based upon:

- Age (ADEA)

- Race, color, religion, sex or national origin (Title VII)

- Pregnancy, childbirth or related medical conditions (PDA)

- Disability (ADA)

- Genetic tests or information (GINA)

An in-depth discussion of the ADA and GINA is included later in this reference material.

Red Flags:

As you will see by reading this material, compliance requirements surrounding a wellness plan can quickly escalate if the plan begins providing additional services. Compliance red flags include the following changes or additions to your wellness plan:

- Biometric screenings;

- Limiting participation to employees enrolled in the health plan;

- An HRA that asks for family medical history or any type of genetic information;

- Incentives that are tied to the attainment of a health standard;

- Incentives that lower the health plan premium or other cost sharing (e.g., deductible); or

- Incentives that contribute additional money to an employee’s FSA plan.

GHP compliance regulations

When a wellness program is a GHP, it must comply with the laws applicable to all GHPs. However, if a wellness plan is embedded in or tied to a group medical plan, compliance with those laws may be easier. This is because the medical plan should already be meeting its GHP compliance responsibilities and the wellness plan can fall under the medical plan’s compliance umbrella. That said, there are also GHP rules that are unique to wellness programs. If the wellness plan is a standalone plan, it must comply with all GHP rules on its own.

GHPs must comply with the following laws and regulations:

ERISA: Applies to all private employers with 2 or more employees. While it includes many requirements, its primary focus is reporting and disclosure – such as plan documents, SPDs and plan notices. Embedded wellness plans can typically fall under the medical plans compliance, although employers should include information about the wellness plan where appropriate (or required), such as in the plan document and SPD.

COBRA: Applies to private employers with 20 or more employees (although employers exempt from COBRA may have other continuation coverage requirements). It requires employers to continue coverage for employees who lose coverage due to a qualifying event. COBRA also has many notice requirements with strict timing and delivery instructions. Embedded wellness plans can rely on the medical plan’s COBRA compliance to fulfill its obligations. However, an employer must consider if, how and when to provide continuation coverage for its wellness plan.

PHSA Mandates: Apply to private, government and church plans. It is unlikely a standalone wellness program can comply with the PHSA mandates, which include provisions requiring specific claims appeals, preventive care, coverage for clinical trials, coverage for preexisting conditions, etc. This makes embedded wellness plans very appealing because the mandates can be satisfied under the medical plan.

HIPAA Nondiscrimination: Applies to private, government and church plans. This regulation is covered in detail later in the reference material.

HIPAA Privacy and Security: Health plans are covered entities subject to HIPAA Privacy and Security. These regulations are burdensome and require policies, training, notices and designated personnel. Although requirements are less rigorous if the health plan is fully insured, it should be noted that many wellness plans are self-funded by the employer even when the medical plan is fully insured through a carrier. In any case, an employer should make every effort to ensure it does not handle PHI. This is easier if the employer uses a third-party vendor to administer the wellness plan; however, this vendor will most likely be considered a business associate of the plan and the appropriate agreements should be in place.

Other Regulations that May Impact Wellness Plans

Regulations that are sometimes overlooked when discussing wellness plans are discussed below:

Cafeteria Plans: Employers must consider the timing of any wellness incentive that impacts premium deductions or FSA contributions. Cafeteria plan rules typically only permit changes at the beginning of a plan year. However, the IRS will allow midyear changes to premium deductions that result from a wellness incentive, provided the cafeteria plan document is written (or amended) to allow this change. In addition, an employer may make a midyear change of its contribution to an employee’s FSA (plan allowing); however, midyear changes of an employee’s contribution to his or her FSA are NOT allowed.

W-2 Reporting: Employers must report the cost of employer provided group health coverage on Form W-2. (Under transition relief, this only applies to employers that file 250 or more W-2s.) If a separate premium is charged for an employee to participate in a wellness plan, this cost must be added to the cost of coverage reported on the W-2. If a separate premium is not charged, employers may add the cost of the wellness plan at their option.

Affordability, Minimum Value and Grandfathered Status: Wellness incentives/penalties can change the amount of premium or cost sharing that an employee pays. For ALEs, wellness incentives/penalties related to tobacco use (only) must be considered when determining a health plan’s affordability and minimum value under the ACA regulations. Employers should also watch that a wellness penalty does not increase the premium or cost sharing amounts above the regulatory maximum for maintaining a grandfathered plan (if applicable).

Summary of Benefits and Coverage (SBC): If the wellness plan is an add-on to medical coverage that could impact a participant’s cost sharing or other information, it should be noted in the SBC. If the SBC describes a wellness incentive that may impact the premium or cost-sharing, it must also describe the reasonable alternative standard.

Nondiscrimination Testing: A health plan or cafeteria plan cannot discriminate against non-highly compensated or non-key employees in terms of eligibility, benefits, or benefit utilization. Employers should be aware that wellness incentives, such as premium reductions or FSA contributions may inadvertently favor highly compensated of key employees causing the plan to fail nondiscrimination tests.

Are Wellness Incentives Taxable?

Incentives that are related to a GHP are generally nontaxable. This includes, for example, premium reductions, cost sharing reductions and contributions to an FSA or HRA. In other words, the incentive will be used toward the purchase of medical care. However, incentives of cash or cash equivalents such as prizes, gift cards, a discount for a gym memberships and the like, are generally taxable.

HIPAA Non-Discrimination

HIPAA Non-Discrimination rules apply to most health plans and therefore encompass wellness plans that are GHPs. They prohibit discrimination against individuals in eligibility, benefits or premiums based on a health factor. HIPAA is administered by the HHS, IRS and the DOL.

HIPAA Non-Discrimination SHORT READ

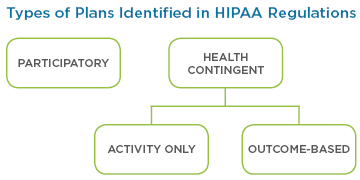

HIPAA defines two main types of wellness plans: Participatory and Health Contingent. There are also two types of Health Contingent plans: Activity Only and Outcome-Based.Incentive Limit: There is no incentive limit for Participatory plans. The incentive limit allowed under both types of Health Contingent plans is 30% of the total cost of the plan in which the employee is enrolled. If the employee does not have to enroll in coverage to participate in the wellness plan, the incentive is calculated using the lowest cost plan. If dependents can participate, the 30% incentive can be based on the cost of coverage in which the employee and dependents are enrolled. The incentive limit can be increased by 20% (50% total) for wellness plans that also include programs designed to prevent or reduce tobacco use.

Incentive Guide: Follow the HIPAA incentive limits if the wellness plan does not ask for genetic information, does not ask for health information (e.g., through an HRA) and does not require employees to participate in medical examinations (e.g., biometric screenings).

HIPAA Non-Discrimination and Wellness Incentives

Final regulations provide guidance specific to wellness plan incentives. This guidance allows discrimination, in terms of different premiums, benefits or cost-sharing brought about by wellness related incentives, if specific rules are followed as described below.

Wellness Plans Under HIPAA Non-Discrimination

HIPAA defines two main types of wellness plans: Participatory and Health Contingent. In addition, there are two types of Health Contingent plans: Activity Only and Outcome-Based.

Participatory Wellness Plans

Plans that do not require an individual to meet a standard related to a health factor to obtain an incentive are considered participatory. Examples of Participatory wellness plans include:

- Fitness center reimbursement program

- Diagnostic testing program that does not base incentives on test outcomes

- Program that waives cost-sharing for prenatal or well-baby visits

- Program that reimburses employees for the cost of smoking cessation aids regardless of whether the employee quits smoking

- Program that provides incentives for attending health education seminars

Health-Contingent Wellness Programs

Plans that require an individual to satisfy a standard related to a health factor to obtain an incentive provided by the plan are considered health-contingent. Incentives can be both financial and in-kind (such as reductions in insurance premiums, cash, time-off awards, prizes, and other items of value, including “trinket” gifts). Incentives also include the avoidance of a penalty for failure to satisfy a standard.

A Health-Contingent wellness plan requires an individual to obtain or maintain a certain health outcome to obtain an incentive, such as:

- Being a non-smoker

- Attaining certain results on biometric screenings

- Exercising a certain amount

Although such an incentive may discriminate based on a health factor, an exception is allowed if the program provides the following safeguards:

- Limited Incentive: The total incentive for all the plan’s wellness programs that require satisfaction of a standard related to a health factor is limited. Generally, it must not exceed 30% (or 50% for programs designed to prevent or reduce tobacco use) of the cost of employee-only coverage under the plan.

- Dependent Coverage: If dependents (such as spouses and/or dependent children) may participate in the wellness program, the incentive must not exceed 30 percent (or 50 percent) of the cost of the coverage in which an employee and any dependents are enrolled.

- Reasonable Design: The program must be reasonably designed to promote health or prevent disease. For this purpose, it must:

- Have a reasonable chance of improving health or preventing disease;

- Not be overly burdensome;

- Not be a subterfuge for discriminating based on a health factor; and

- Not be highly suspect in method.

- Annual Opportunity: The program must give eligible individuals an opportunity to qualify for the incentive at least once per year.

- Reasonable Alternative: The incentive must be available to all similarly situated individuals. For this purpose, a reasonable alternative standard (or waiver of the original standard) must be made available to individuals for whom it is unreasonably difficult due to a medical condition to satisfy the original standard during that period (or for whom a health factor makes it unreasonably difficult or medically inadvisable to try to satisfy the original standard).

- Disclosure: The availability of a reasonable alternative standard (or waiver of the original standard) must be disclosed in all plan materials describing the terms of the program.

HIPAA Wellness Incentives

Participatory wellness plans do not have an incentive limit. The maximum incentive under Health-Contingent wellness plans is 30% of the cost of coverage in which the individual is enrolled. This can include the cost of dependent coverage only if dependents can participate in the wellness plan. An additional 20% is available for programs designed to prevent tobacco use. However, plans must also take into account limits imposed by the EEOC under the ADA and GINA which may be lower.

The category of Health-Contingent wellness plans is subdivided into: Activity-Only wellness plans, and Outcome-Based wellness plans.

Activity-Only (Health-Contingent Wellness Plans)

These plans require an individual to perform or complete an activity related to a health factor to obtain an incentive. Activity-Only wellness plans do not require an individual to attain or maintain a specific health outcome. Examples include a walking, diet or exercise program.

Outcome-Based (Health-Contingent Wellness Plans)

These plans require an individual to attain or maintain a specific health outcome to obtain an incentive. Generally, these programs have two tiers:

- A measurement, test, or screening as part of an initial standard; and

- A larger program that then targets individuals who do not meet the initial standard with wellness activities.

For individuals who do not attain or maintain the specific health outcome, compliance with an educational program or an activity may be offered as an alternative to achieve the same incentive. However, this alternative pathway does not mean that the overall program, which has an outcome-based initial standard, is not an outcome-based wellness program. That is, if a measurement, test, or screening is used as part of an initial standard and individuals who meet the standard are granted the incentive, the program is considered an outcome-based wellness program.

Examples of outcome-based wellness programs include a program that tests individuals for specified medical conditions or risk factors (such as high cholesterol, high blood pressure, abnormal BMI, or high glucose level) and provides an incentive to employees identified as within a normal or healthy range (or at low risk for certain medical conditions). It further requires employees who are identified as outside the normal or healthy range (or at risk) to take additional steps (such as meeting with a health coach, taking a health or fitness course, adhering to a health improvement action plan, or complying with a health care provider’s plan of care) to obtain the same incentive.

Reasonable Alternative Standard (RAS)

A health-contingent wellness program must provide a reasonable alternative standard (or waiver of the otherwise applicable standard) and, if necessary, provide a different, reasonable means of qualifying for the incentive. In addition, the same, full incentive must be available to individuals who qualify by satisfying the RAS.

Plans and issuers have flexibility to determine whether to provide the same RAS for an entire class of individuals or provide the RAS on an individual-by-individual basis, based on the facts and circumstances presented.

Timing of RAS Payment

Example:

If a calendar year plan offers a Health-Contingent wellness plan with a premium discount and an individual who qualifies for a reasonable alternative standard satisfies that alternative on April 1, the plan or issuer must provide the premium discounts for January, February, and March to that individual.

Plans and issuers have flexibility to determine how to provide the portion of the incentive corresponding to the period before an alternative was satisfied (e.g., payment for the retroactive period or pro rata over the remainder of the year), if the method is reasonable, and the individual receives the full amount of the incentive. In some circumstances, an individual may not satisfy the RAS until the end of the year. In this case, the plan or issuer may provide a retroactive payment of the incentive for that year within a reasonable time after the end of the year, but may not provide pro rata payments over the following year (a year after the year to which the incentive corresponds).

RAS: Activity-Only

An RAS (or waiver of the original standard) must be made available to any individual for whom, for that period, it is either unreasonably difficult due to a medical condition to meet the original standard, or it is medically inadvisable to attempt to satisfy the original standard.

Under an activity-only wellness plan, it is permissible for a plan to seek verification, such as a statement from the individual’s personal physician, that a health factor makes it unreasonably difficult for the individual to satisfy the otherwise applicable standard.

RAS: Outcome-Based

For outcome-based wellness plans, the RAS (or waiver of the otherwise applicable standard) must be offered to any individual who does not meet the initial standard.

If the RAS is a requirement to meet a different level of the same standard, additional time to comply must be given. In addition, individuals have the right to instead comply with the recommendations of their personal physicians as a second RAS.

Note: Under an Outcome-Based wellness plan, the plan cannot ask for physician verification that a health factor makes it unreasonably difficult for the individual to satisfy a standard.

RAS: Disclosure

The plan must disclose in all plan materials describing the terms of the Health-Contingent wellness plan:

- The availability of an RAS (or a waiver of the standard) to qualify for the incentive;

- Contact information for obtaining the alternative; and

- A statement that recommendations of an individual’s personal physician will be accommodated.

If the plan materials merely mention that a wellness plan is available, without describing its terms, the disclosure is not required. In addition, for Outcome-Based-wellness programs, this information must also be included in any disclosure that an individual did not satisfy an initial Outcome-Based standard (e.g., a notice that an individual did not meet the BMI target range to qualify for the incentive).

Americans with Disabilities Act (ADA)

Under the ADA, an employer may not deny an individual with a disability equal access to insurance, or require such an individual to have terms and conditions of insurance different than those of employees without disabilities. It generally applies to all private, state, and local governmental employers with 15 or more employees. The ADA is administered by the EEOC.

ADA SHORT READ

Wellness plans may only make disability related inquiries (e.g., HRAs that ask about an employee’s health) or perform medical examinations (e.g., biometric screenings) if the programs are voluntary.

Incentive Limit: To be voluntary under the ADA, the wellness plan cannot offer an incentive greater than 30% of the cost of employee only coverage to collect disability related information.

The incentive calculation differs from the HIPAA incentive in several important ways. Under the EEOC’s rules, the self-only coverage used as a benchmark to calculate the 30% varies depending on the number of group health plans sponsored by the employer and whether coverage in one of those plans was required to participate in the wellness program.

- Group health plan coverage required. If participation in the wellness program was limited to employees enrolled in a group health plan, then the 30% limit was based on the total cost of self-only coverage under the group health plan in which the employee was enrolled.

- One plan offered, but coverage not required. If the employer (or other covered entity) offered only one group health plan and participation in the wellness program was offered to all employees regardless of whether they were enrolled in that plan, then the 30% limit was based on the total cost of self-only coverage under that plan.

- Multiple plans, but coverage not required. If the employer (or other covered entity) offered more than one group health plan but participation in the wellness program was offered to employees whether or not they were enrolled in a particular plan, then the 30% limit was based on the total cost of the lowest-cost self-only coverage under any of the offered major medical group health plans.

- No group health plans offered. If the employer (or other covered entity) did not offer a group health plan or group health insurance coverage, then the 30% limit was based on the cost of self-only coverage under the second lowest-cost silver plan for a 40-year-old non-smoker on the state or federal health care Exchange in the location that the covered entity identified as its principal place of business.

Incentive Guide: If the wellness plan offers an incentive for employees to answer questions about their health (e.g., through an HRA) or participate in medical examinations (e.g., biometric screenings), follow the ADA limits.

Notice: A notice that conveys information specified in the regulation must be provided prior to an employee’s participation, giving the employee enough time to decide whether to participate in the program.

* In the case of AARP v. EEOC, the court determined the EEOC had failed to adequately justify the 30% incentive limit that it set forth in its regulation. The court later vacated the incentive regulation (i.e., it will no longer be enforced) as of January 1, 2019. It is anticipated that the EEOC will propose new regulations in June of 2019. ComplianceDashboard will provide updates with any new developments as they occur.

The ADA is employer focused, and therefore applies to wellness programs whether or not they are GHPs. More particularly, it applies whether the wellness program is:

- offered only to employees enrolled in an employer-sponsored group health plan;

- offered to all employees regardless of whether they are enrolled in such a plan; or

- offered as a benefit of employment by employers that do not sponsor a group health plan or group health insurance.

HIPAA vs ADA

The wellness incentive restrictions under HIPAA and the ADA, while similar, are not the same. GINA, discussed later in this reference material, adds additional restrictions. Employers must consider each regulation when designing a wellness plan.

ADA’s Impact on Wellness Plans

The ADA requires employers to provide reasonable accommodations (adjustments or modifications) that allow employees with disabilities to participate in wellness programs and to keep any medical information gathered as part of the wellness program confidential. It also generally restricts employers from obtaining medical information from employees, but allows them to make inquiries about an employees’ health or do medical examinations that are part of a voluntary employee health (or wellness) program that is reasonably designed.

When is a Wellness Program Considered Voluntary?

For disability-related inquiries or medical examinations to be considered voluntary, an employer:

- May not deny any employee who does not participate in a wellness program access to health coverage or prohibit any employee from choosing a particular plan; and

- May not take any other adverse action or retaliate against, interfere with, coerce, intimidate, or threaten any employee who chooses not to participate in a wellness program or fails to achieve certain health outcomes.

Also, an employer must comply with the incentive limits explained below.

Reasonable Design Under the ADA

The reasonable design requirement is more specific than the parallel provision under HIPAA. For example, a wellness program that asks employees to answer questions about their health conditions or have a biometric screening or other medical examination for the purpose of alerting them to health risks (such as having high cholesterol or elevated blood pressure) is reasonably designed to promote health or prevent disease. However, asking employees to provide medical information on an HRA without providing any feedback about risk factors or without using aggregate information to design programs or treat any specific conditions would not be reasonably designed to promote health or prevent disease.

Wellness Incentives Under the ADA

The voluntary aspect of a wellness program is most significant when determining incentives for employees who provide health history through a Health Risk Assessment (HRA) or undergo biometric screenings. The 2016 ADA final rule provides specific guidance in this area.

Unlike HIPAA, the ADA places limits on disability-related inquiries (this will include the typical HRA) and medical examinations related to wellness programs, regardless of how the information is ultimately used. Therefore, the limit on incentives applies to any wellness program that requires employees to answer disability-related questions or undergo medical examinations (whether it is participatory or health contingent under HIPAA). Like HIPAA, the rule makes clear that the term “incentives” includes both financial and in-kind incentives (such as reductions in insurance premiums, cash, time-off awards, prizes, and other items of value, including “trinket” gifts). Employers have the obligation to reasonably establish the value of such awards.

Under the ADA’s final rule, wellness programs that ask questions about employees’ health (e.g., through an HRA) or include medical examinations (e.g., biometric screenings) may offer incentives of up to 30% * of the total cost of self-only coverage under the group health plan.

Employers should use the plan in which the employee is actually enrolled to calculate the incentive. Unlike HIPAA, the cost of dependent coverage cannot be used even if dependents can participate in the wellness plan. If participation in a group health plan is not required to earn a wellness incentive, employers should use the lowest cost group health plan to calculate the maximum incentive.

* In the case of AARP v. EEOC, the court determined the EEOC had failed to adequately justify the 30% incentive limit that it set forth in its regulation. The court later vacated the incentive regulation (i.e., it will no longer be enforced) as of January 1, 2019. It is anticipated that the EEOC will propose new regulations sometime in 2018. ComplianceDashboard will provide updates with any new developments as they occur.

Smoking Cessation Under the ADA

The ADA makes a distinction between smoking cessation programs that require employees to be tested for nicotine use and programs that merely ask employees if they smoke.

No Limit: The ADA incentive limit does not apply to a wellness program that merely asks employees whether they use tobacco (this is not a disability related question). However, HIPAA limits may apply if the employee is required to be or become smoke-free as a condition of earning an incentive under a group health plan.

30% * Limit: If an employer requires any biometric screening or other medical procedure that tests for the presence of nicotine or tobacco, the ADA’s 30% * incentive limit applies. Even if HIPAA applies, the additional 20% incentive available under HIPAA could not be given.

* In the case of AARP v. EEOC, the court determined the EEOC had failed to adequately justify the 30% incentive limit that it set forth in its regulation. The court later vacated the incentive regulation (i.e., it will no longer be enforced) as of January 1, 2019. It is anticipated that the EEOC will propose new regulations sometime in 2018. ComplianceDashboard will provide updates with any new developments as they occur.

Notice Requirement Under the ADA

To ensure that an employee’s participation is voluntary, an employer must provide a notice that clearly explains:

- What medical information will be obtained;

- How it will be used;

- Who will receive it; and

- Restrictions on its disclosure.

The notice must be provided before the collection of information, giving the employee enough time to decide whether to participate in the program.

The EEOC has provided a sample notice and additional information is included in the When To Provide Wellness Notices Section.

Other Requirements

While the discussion above has concentrated on ADA regulations specific to wellness programs, it is important to remember that other, more general requirements also apply. These include the obligation of the employer to make reasonable accommodations for employees who cannot meet a program’s incentive requirements due to a disability.

In addition, employers may not obtain individually identifiable health information except as needed to administer the program. Any information that is acquired must be collected and maintained on separate forms and treated as a confidential medical record. This obligation will likely be satisfied by an employer who is otherwise compliant with HIPAA’s privacy and security rules but employers should be alert to circumstances where the HIPAA rules do not apply because the wellness program is not a group health plan.

Genetic Information Nondisclosure Act (GINA)

Titles I and II of GINA prohibit discrimination in group health plans and employment respectively on the basis of genetic information. It applies to employers with 15 or more employees, including state and local governments.

Genetic information includes:

- Information about an individual’s genetic tests;

- Information about the genetic test of a family member;

- Family medical history (including information about an employee’s spouse);

- Requests for and receipt of genetic services by an individual or a family member; and

- Genetic information about a fetus carried by an individual or family member or of an embryo legally held by an individual or family member using assisted reproductive technology.

GINA regulates wellness programs when they request genetic information from an employee. This most often occurs when family medical history is included in an HRA.

GINA SHORT READ

Title I of GINA prohibits the collection of genetic information for underwriting purposes of a group health plan. Because a wellness incentive may change the cost of insurance, it is included in the regulation’s definition of underwriting purposes.

Incentive Limit: No incentive can be offered for the completion of an HRA that asks for genetic information, including family medical history. Please note that tobacco use is not considered genetic information.

Incentive Guide: It is unlawful for a wellness plan to offer a wellness incentive in exchange for genetic information. Employers may want to consider using two HRAs: one that asks for genetic information and does not provide an incentive; and, a second one that does not ask for genetic information but provides an incentive to those who complete it. The maximum incentive available for completion of the second HRA is determined by the ADA incentive limits.

GINA Title I

GINA Title I applies directly to group health plans. It prohibits the collection of genetic information for underwriting purposes of a group health plan. Because a wellness incentive may change the cost of insurance, it is included in the regulation’s definition of underwriting purposes. This means that an incentive cannot be provided for the completion of an HRA that asks for genetic information, including family medical history. Please note that an employee’s, spouse’s or dependent’s tobacco use is not considered genetic information. Also note that an HRA may ask for genetic information, including family history, as long as no incentive is given for providing this information.

Example

Some HRAs that do not include specific questions involving genetic information may still contain open-ended questions that might elicit such information. For example, an HRA may ask: “Is there anything else relevant to your health that you would like us to know or discuss with you?” This will be deemed to be an HRA that requests genetic information unless the HRA also incorporates an explicit direction not to provide such information, such as: “In answering this question, you should not include any genetic information. That is, please do not include any family medical history or any information related to genetic testing, genetic services, genetic counseling, or genetic diseases for which you believe you may be at risk.”

Title I also prohibits collection of genetic information prior to or in connection with enrollment in a group health plan. After enrollment, an HRA can ask for genetic information, if no incentive is provided for its completion. Employers may want to consider using two HRAs: one that does not ask for genetic information and provides an incentive to those who complete it; and, a second one that asks for genetic information but does not provide an incentive. The maximum incentive available for completion of the first HRA is determined by the ADA regulations on Wellness Plans.

GINA Title II

Title II generally applies when a wellness plan is not a GHP and is offered outside of an employer’s group health coverage. It prohibits discrimination in any aspect of employment on the basis of genetic information. Employment includes “privileges of employment,” which encompasses wellness programs whether or not they are considered a group health plan.

An employer may acquire genetic information about an employee or his or her family members when it offers health or genetic services, including wellness programs, on a voluntary basis. It may also offer an incentive for completing a health risk assessment that includes questions about family medical history or other genetic information, if those questions are specifically identified and it is clear that the individual need not answer the questions that request genetic information in order to receive the incentive.

Under this scenario, specific requirements must be met:

- The wellness program be voluntary;

- The individual must provide prior knowing, voluntary, and written authorization;

- Individually identifiable information may be provided only to the individual from whom it was obtained; and

- Plan sponsors are entitled only to receive information in aggregate terms that do not disclose the identity of specific individuals.

The maximum incentive available is determined by the ADA regulations on Wellness Plans.

In addition, if a wellness program collects family history or genetic information it must be reasonably designed to improve health or prevent disease. This means that it:

- Must have a reasonable chance of improving the health of, or preventing disease in, participating individuals;

- Cannot be overly burdensome;

- May not be a subterfuge for violating GINA or other laws prohibiting employment discrimination; and

- Cannot be highly suspect in the method chosen to promote health or prevent disease.

Example

Programs consisting of screenings or an HRA without providing results, follow-up information, or advice designed to improve the participant’s health would not be reasonably designed to promote health or prevent disease, unless the collected information actually is used to design a program that addresses at least a subset of conditions identified.

For plan years beginning on or after January 1, 2017, wellness programs may offer incentives for information provided by an employee’s spouse’s manifestation of disease or disorder as part of an HRA. However, the incentive may not be offered for any other genetic information about the spouse. The maximum incentive is calculated as follows:

- 30% * of the cost of self-only coverage under the plan in which the individual is enrolled (plan sponsors must always coordinate potential incentive limits with restrictions under HIPAA and the ADA).

- If the employer offers multiple health plans and participation is not required to earn the wellness incentive, the 30% * is based on the lowest cost health plan available.

- If the employer does not offer a group health plan providing major medical coverage, the 30% * is based on the cost of self-only coverage available to an individual who is 40 years old and a non-smoker under the second-lowest-cost silver plan available through the Exchange in the location of the employer’s principal place of business.

- As when providing any genetic information, the participant must provide prior knowing, voluntary and written authorization.

- The incentive for providing the spouses health history may be in addition to the 30% * available to employees under the ADA (i.e., 60% total).

The Amendments also make clear that an employer cannot offer incentives to acquire genetic information on an employee’s children.

* In the case of AARP v. EEOC, the court determined the EEOC had failed to adequately justify the 30% incentive limit that it set forth in its regulation. The court later vacated the incentive regulation (i.e., it will no longer be enforced) as of January 1, 2019. It is anticipated that the EEOC will propose new regulations sometime in 2018. ComplianceDashboard will provide updates with any new developments as they occur.

Consent Form

GINA requires that a spouse provide knowing and voluntary authorization prior to providing family medical history or genetic information. To obtain this information the consent form should:

- Be written in a language reasonably likely to be understood by the individual from whom the information is sought;

- Describe the information being requested; and

- Describes the safeguards in place to protect the information against unlawful disclosure.

Use of Third Parties

As a review of this reference material makes clear, the laws surrounding wellness plans are copious and complex. Many employers, therefore, turn to third party vendors to design and administer their programs. This is probably a good decision for employers who sponsor all but the most basic wellness plans.

When a wellness plan is considered a group health plan, compliance with HIPAA privacy and security alone make using a third-party a wise choice. In most cases, the vendor will be a business associate of the covered entity (group health plan) and should collect all the PHI, providing only summary data back to the plan and the employer. As noted above, wellness programs that are not health plans also have HIPAA-like privacy and security obligations.

Most wellness vendors will also be well versed in the many other laws covered in this reference material. However, as is true with a medical plan, the plan sponsor (typically the employer) retains the ultimate responsibility and liability for legal compliance even if a third party is performing the services.

When to Provide Wellness Notices

There are various notice and disclosure requirements under the laws described in this reference material. These requirements are triggered by the following circumstances:

1. Incentive is offered under a (HIPAA) Health-Contingent wellness plan.

Rather than an actual notice, a disclosure is required under the HIPAA Nondiscrimination provisions that an RAS is available and who to contact for more information.

Timing

The disclosure of an RAS and contact information must be made in all plan materials that describe the health-contingent incentive.

In addition, for outcome-based wellness programs, this information must also be included in any disclosure that an individual did not satisfy an initial outcome-based standard (e.g., a notice that an individual did not meet the BMI target range to qualify for the incentive).

Sample Language

Your health plan is committed to helping you achieve your best health. Incentives for participating in a wellness program are available to all employees. If you think you might be unable to meet a standard for an incentive under this wellness program, you might qualify for an opportunity to earn the same incentive by different means. Contact us at [insert contact information] and we will work with you (and, if you wish, with your doctor) to find a wellness program with the same incentive that is right for you in light of your health status.

2. Incentive is offered for participating in a voluntary HRA or medical examination.

Employers who are subject to the ADA and offer wellness programs that collect employee health information must provide a notice to participants that describes how the information that is collected will be used, shared and kept confidential.

Employee Health Information

The notice requirement is triggered when wellness programs collect health information through voluntary health risk assessments (HRAs) or voluntary biometric screenings that include medical examinations, such as tests to detect high blood pressure, high cholesterol, or diabetes.

Notice Content

The notice must explain what information will be collected, how it will be used, who will receive it, and what will be done to keep it confidential. It should be described in a manner that is reasonably likely to be understood by employees. The EEOC has provided a sample notice, which allows employers to tailor their notices to the specific features of their wellness programs.

WELLNESS VENDOR

An employer can have its wellness vendor distribute the notice, but the employer is still responsible for ensuring that employees receive it.

Notice Format and Distribution

The notice can be given in any format that will be effective in reaching employees being offered an opportunity to participate in the wellness program. For example, it may be provided in hard copy or as part of an email sent to all employees with a subject line that clearly identifies what information is being communicated (e.g., “Notice Concerning Employee Wellness Program”). Avoid providing the notice along with a lot of information unrelated to the wellness program because employees might ignore or misunderstand the contents of the notice. Employees with disabilities may need to have the notice available in an alternative format that accommodates their disability.

Timing

The EEOC’s rule does not require that employees get the notice at a particular time, but they must receive it before providing any health information, and with enough time to decide whether to participate in the program. Waiting until after an employee has completed an HRA or medical examination to provide the notice is illegal.

Sample Language

The EEOC has provided a sample notice and Q&As.

3. Genetic information is requested from spouse.

GINA requires that a spouse provide knowing and voluntary authorization prior to providing family medical history or genetic information. The consent form should be written in a way that the spouse is reasonably likely to understand. The form must describe the information that will be obtained, the general purposes for how it will be used, and the restrictions that will apply to its disclosure.

Timing

The notice must be provided before the collection of information, giving the employee enough time to decide whether to participate in the program.

Penalties

Violations of GINA, such as establishing eligibility rules based on genetic information or requesting genetic information for underwriting purposes, may result in penalties of $117 per participant per day.

Material contained in ComplianceDashboard is a compilation of generally published information by the Department of Labor and other public agencies regulating employee benefit plans and employee benefit issues. It is not legal advice, and should not be construed as legal advice. If legal advice or other professional assistance is or may be required with regard to any issues referenced in this website, the services of a competent legal or tax professional should be immediately sought. The inclusion of links within the ComplianceDashboard website is for informational purposes only. ComplianceDashboard does not warrant the accuracy of information outside this website that is found as a result of following links contained herein, nor does the inclusion of those links herein constitute endorsement of the content of any other website. If you have questions regarding this disclaimer, please contact us at 877-328-7880.